Pandemic didn’t just affect our mental health, but it also impacted our relationship with money. As per the Money and Machines report by Oracle, people now trust AI-powered machines more than humans to manage their finances. This observation has consequences for how we want money to function for us. It is no longer just another asset. Today’s money must be more flexible and provide more freedom, opportunities, and power. Digital disruption in BFSI caters to this evolved viewpoint.

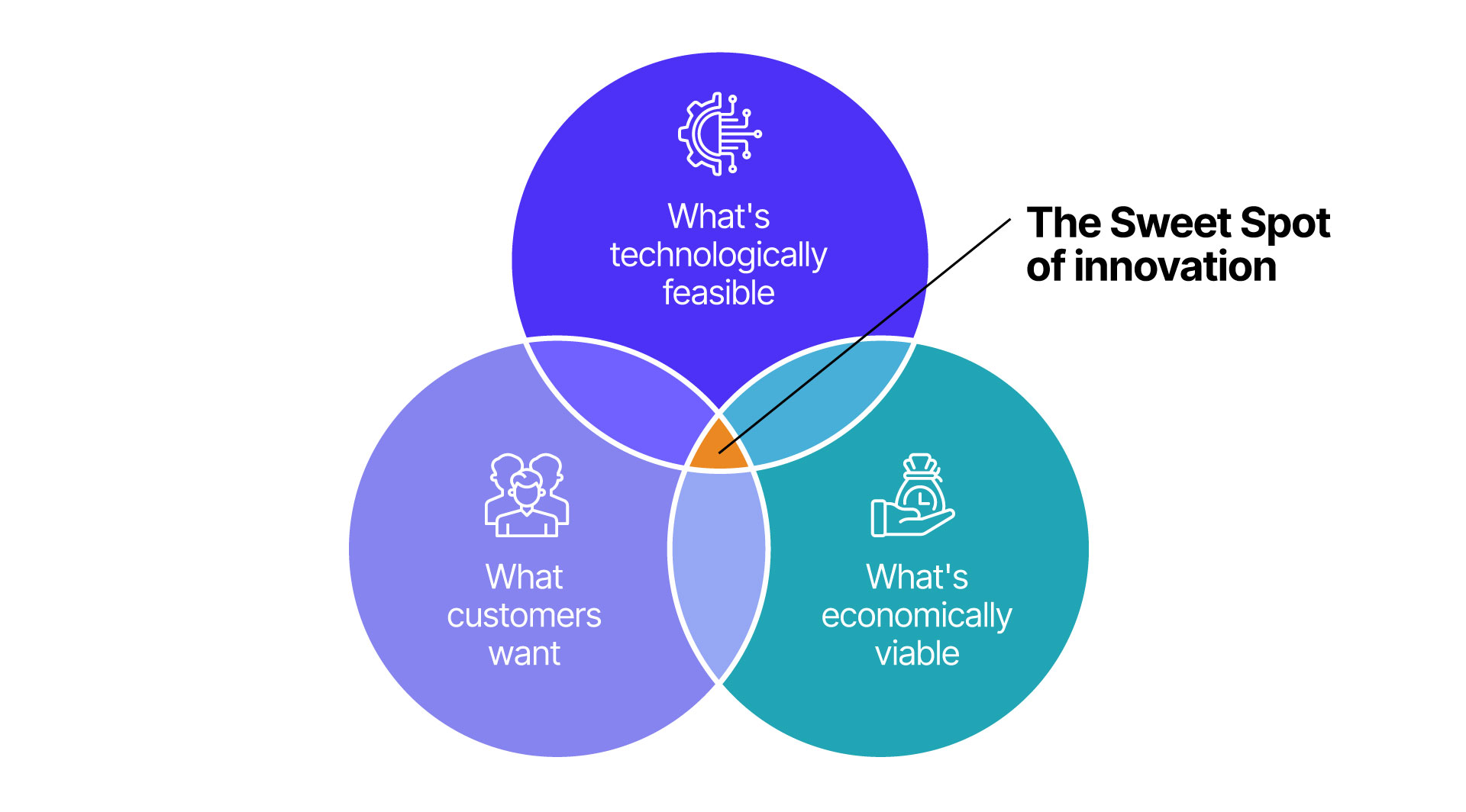

Digital innovation in BFSI was enabled when the three forces found the familiar sweet spot.

- What customers wanted – more convenience, freedom, flexibility and experience

- What was technologically feasible – emerging technologies like AI, Blockchain, Automation and Cloud

- What was economically viable – solutions that added to operational agility, catered to evolving customer and market needs and were in sync with dynamic business requirements

The result was a proliferation of innovative products like net banking, mobile banking, phone banking, digital payments, smart contracts, digital currencies, neobanking, AI-powered financial solutions, and intelligent chatbots – offering customers convenience, inclusion, and personalization.

Follow our newsletter for more insights.

In short, the sweet spot of innovation has helped traditional banks and financial institutions to

- Remain relevant in the evolving market

- Diversify their product portfolio to cater to newer needs

- Compete successfully with the digital native entrants

Of course, digital disruption also made operations more efficient, enhanced workforce productivity, lowered costs and helped businesses manage today’s complex and interconnected ecosystems. But as these emerging technologies become more commonplace in BFSI, their second-order consequences of digital innovation unveil themselves, forcing organizations to look for solutions to deal with them. Often, these consequences reveal themselves as risks.

So, in this blog post today, we will talk about two significant digital risks and how digital assurance can help navigate them seamlessly:

Performance Risk

Performance risk in digital products and solutions could be in the form of

- Compatibility issues that go undetected

- Unplanned downtimes and outages that not only disrupt the normal functioning of the product but also frustrate customers

- Breakdown from overcapacity/higher than regular traffic during peak season

- Latency issues that slow down performance

- Unexpected error messages hindering transactions and data transfer

- Navigational challenges

While your financial product/service could be a real problem solver for your customer, ensure financial product/service design and development thoroughly to prevent errors, bugs, high customer churn rate, revenue loss, and loss of trust. If it’s not assured thoroughly during the design and development stage, it might throw up errors/bugs, which would not only lead to an inconvenient customer experience but also a high customer churn rate and loss of revenue and trust.

Digital assurance meticulously validates the performance of digital products through rigorous testing and continuous monitoring. It empowers organizations to proactively address concerns of functionality, security, performance, and user experience.

Digital assurance involves thorough assessments of functionalities, performance testing, security protocols, usability testing, and continuous monitoring to ensure products meet or exceed performance expectations, ensuring a seamless and reliable user experience in the digital realm.

Compliance Risk

In the BFSI sector, compliance risks for digital products center around data privacy, security, and ESG (Environmental, Social, Governance) standards.

Data privacy breaches not only pose reputational risks but also incur regulatory penalties. Stringent security measures are imperative to counter evolving cyber threats and safeguard sensitive financial information.

ESG compliance is increasingly critical, with stakeholders emphasizing ethical practices. Non-compliance risks legal repercussions and diminished consumer trust.

Digital assurance in the BFSI sector is a pivotal safeguard against compliance risks in digital solutions. Rigorous testing validates adherence to data privacy regulations, ensuring secure handling of sensitive financial information.

Continuous monitoring identifies and rectifies vulnerabilities, mitigating the risk of breaches. Comprehensive testing protocols also assess the efficacy of security measures, fortifying digital solutions against evolving cyber threats. By proactively addressing these concerns, digital assurance becomes a cornerstone in the BFSI sector, fostering trust, meeting regulatory requirements, and bolstering the resilience of digital solutions.

In its recent article titled, The Bank of 2030, Deloitte stated, “…the bank of the future will need to embrace emerging technology, remain flexible to adopt evolving business models and put customers at the center of every strategy…” As we now know, embracing emerging technologies is a path riddled with risks, all of which can be navigated smoothly by implementing robust digital assurance practices.